New Legislation: Amendment to the Enforcement Decree of the Act on External Audit of Stock Companies

|

|

| The amendment to the Act on External Audit of Stock Companies (the “Act”) will become effective as of November 1, 2018. For more details on the amendment to the Act, please visit [New Legislation: Amendment to the Act on External Audit of Stock Companies].

In connection with the amendment to the Act, the Financial Services Commission issued a notice of legislation for the proposed amendment to the Enforcement Decree of the Act (the “Proposed Enforcement Decree”) on April 19, 2018, which will also be effective as of November 1, 2018 (subject to certain caveats as set forth in Section 5 below). The Act (as amended) and the Proposed Enforcement Decree include the following changes:

|

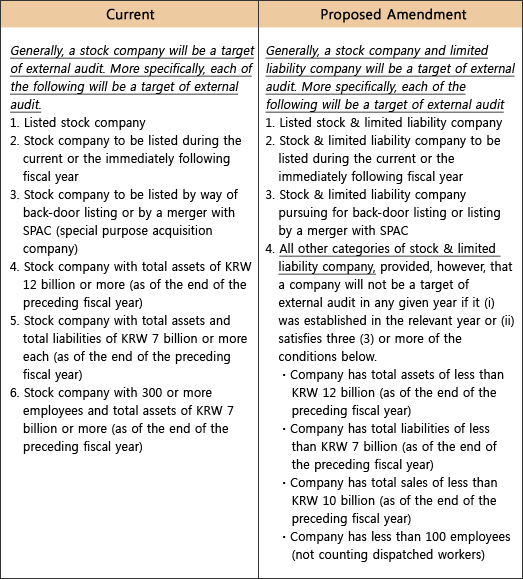

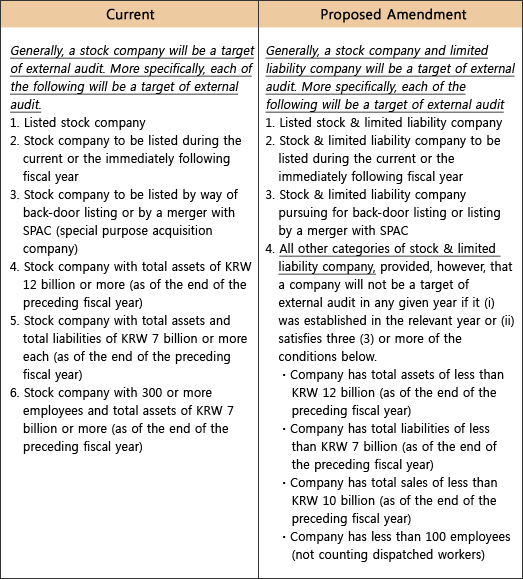

1. Requirement for External Audit ? Revised Category of Targets

|

| The Act (as amended) and the Proposed Enforcement Decree set forth a revised category of targets of external audits, which now includes limited liability companies. The revised category also stipulates updated thresholds (assets, liabilities, sales and/or number of employees) for unlisted companies to become targets of external audits. A summary of the key revisions is as follows (Article 5 of the Proposed Enforcement Decree):

|

|

|

2. Requirement to File Financial Statements ? Revised Category of Companies

|

| The Act (as amended) and the Proposed Enforcement Decree also set forth a revised category of companies that are required under the Act to file financial statements with the Securities and Futures Commission.

The category now includes (i) listed stock & limited liability companies, (ii) unlisted stock & limited liability companies with total assets of KRW 100 billion or more (as of the end of the preceding fiscal year) and (iii) financial institutions as defined under the Act on the Structural Improvement of the Financial Industry are subject to the requirement (Article 6(4) of the Act; Article 8(3) of the Proposed Enforcement Decree).

: |

3. Requirement to File Reports ? Auditor (Accounting Firm)

|

| Under the Act (as amended), an auditor (an accounting firm) will be required to file a report with the Securities and Futures Commission in any event that may have any material impact on the accounting firm’s management, properties and quality control processes of audit reports, among others.

The Proposed Enforcement Decree sets forth a more specific list of those events that trigger the requirement set forth above, as follows: (i) any extraordinary circumstances were detected during an audit process, (ii) any material change took place within the accounting firm and (iii) the management of the accounting firm is expected to change in any material way due to administrative sanctions or other external factors (Article 28(3) of the Proposed Enforcement Decree).

: |

4. Miscellaneous

|

| In addition to the foregoing, the Proposed Enforcement Decree stipulates the following changes: (i) companies will be required to include in their internal accounting regulations the criteria and procedures for evaluation of the internal accounting protocols by the audit committee (Article 9(2)); (ii) the Securities and Futures Commission will have the power and authority to designate an external auditor on behalf of a KOSDAQ-listed company in the event the company is designated as “KOSDAQ Investment Precaution Issue”, etc. (Article 14(1), (3) and (5)); and (iii) an auditor will be entitled to terminate an audit agreement with a company if the company fails to cooperate with the auditor and fails to provide the relevant documents/information (Article 21(1) and (3)). |

5. Effective Date

|

| The Proposed Enforcement Decree will become effective as of November 1, 2018. It should be noted, however, that certain provisions relating to the category of targets of external audits will become effective with respect to the fiscal years that commence on or after November 1, 2019. Therefore, for the majority of companies whose fiscal years begin on January 1 and ends on December 31 of each year, the revised category will become effective with respect to the fiscal year that begins on January 1, 2020. |

|

|

|

|

|

|

|